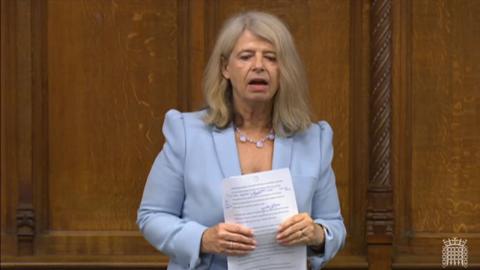

MP Harriet Baldwin, the chair of the Treasury Committee, expressed dissatisfaction with HMRC’s decision to close the self-assessment helpline, describing their reasoning as inadequate. HMRC defended their actions in a letter to Baldwin, highlighting that the closure is a pilot project and citing lower phone line usage during the summer. They also attributed some blame to the efficiencies required by the 2021 spending review settlement. However, HMRC admitted that they did not consult external organisations before announcing the closure.

The Treasury Committee’s scrutiny of HMRC comes after the Revenue’s sudden announcement in June that the self-assessment phone line would temporarily close until September 4th. Taxpayers were given only four days’ notice and directed to rely on digital services for support.

In the letter to Baldwin, Angela MacDonald, HMRC’s deputy chief executive, justified the hiatus of the self-assessment phone line, explaining that demand is seasonal and fewer calls are received during the summer. MacDonald acknowledged the challenge of meeting efficiency targets set by the 2021 spending review settlement, which was further impacted by inflation and policy decisions, affecting the number of taxpayers served, especially those with complex affairs.

Baldwin expressed frustration with HMRC’s lack of transparency in their responses to the Treasury Committee. MacDonald confirmed that HMRC did not consult external bodies prior to the trial but emphasised their long-term direction of promoting digital and self-service channels.

MacDonald outlined the data to be collected during the trial, including monitoring the number of taxpayers seeking digital assistance and their satisfaction levels, as well as additional contact through other HMRC telephone lines. The success of the pilot will be evaluated in early 2024, taking into account the usage of digital services and contact through HMRC web chat.

HMRC will monitor the nature of phone calls and whether taxpayers delayed contacting the helpline until it reopened. MacDonald assured Baldwin that vulnerable taxpayers would receive support in using digital services through HMRC’s online support help desk and extra support team.

Regarding contingency plans, MacDonald stated that if the trial does not yield expected results, the helpline can be reopened. She clarified that the decision to pilot the seasonal model was not driven by the tax department’s homeworking policy and assured that there would be no reduction in staff or hours worked.

MacDonald stated that the change was intended to test HMRC’s commitment to supporting customers through digital channels, enhancing services and productivity. The pilot would free up approximately 350 advisers to handle urgent calls and post.

MacDonald emphasised the push for taxpayers to utilise HMRC’s digital services, as they provide higher customer satisfaction compared to traditional phone and postal services. She further justified the summer shutdown by highlighting that 97% of SA taxpayers file their returns online, and two-thirds of helpline calls involve issues that can be resolved digitally through online guidance, the digital assistant, or accessing the customer’s own online tax account or the HMRC App.

For information on your specific circumstances and how this article affects you directly, contact us today.

Latest Articles

FCA Review Offers Insights on the Consumer Duty in the Payments SectorAvoiding Problems When Switching to New Payroll IDs or Payroll ProvidersNew Calls for a UK Investment Strategy which supports industries with world-class capabilitiesTax Reform and Modernisation: Rachel Reeves’ New Plan for HMRCAnti Money Laundering (AML) Supervision Needs Improvement: OPBAS Report Highlights Key Concerns