Crucial Update on Business Asset Roll-Over Relief (ROR) Claims

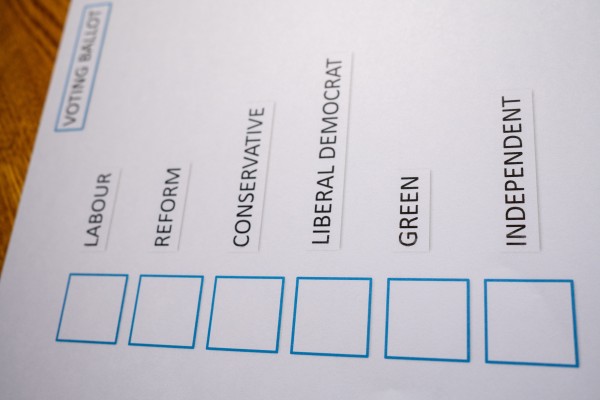

Explaining the Tax Policies from the 2024 General Election Manifestos

Professional Bodies Advocate for Mandatory HMRC Registration to Elevate Tax Advice Standards

The Spring Finance Bill has received Royal Assent

Urgent Alert for Wealthy Taxpayers: Avoid Penalties by Filing Overdue Returns Now

Fake Payslips From Suppliers: Essential Warning Signs

ICAEW says the General election provides a great opportunity to restore UK resilience