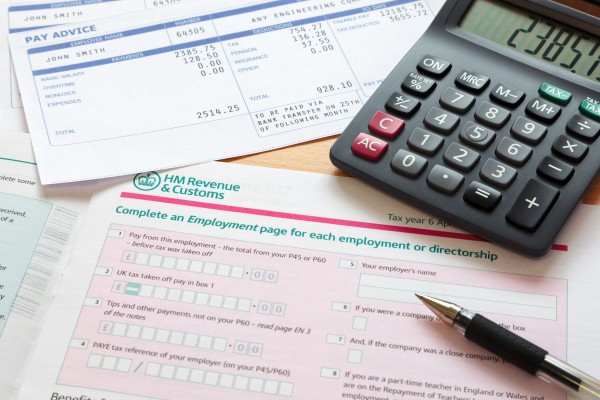

IR35: HMRC consulting on offsets of NICs and tax

Cyber Security Risks are a top concern for 2024

Key Tax Dates for February

HMRC challenge Parliament as CJRS debate fails to stand up in court.

The changes to R&D and when they apply.

Requirements for the Preparation and Filing of Accounts Have Changed

Changes to creative industry tax relief announced